Study: How to gain organizational agility

The future of financial services companies belongs to those that are agile, both in their business planning process and in their ability to adapt to new market conditions.

adminA1S

There is no doubt that companies in the financial services industry still want to thrive in the digital age. The global pandemic has highlighted the need to be able to make changes to the business at any time. It is not a lack of will that prevents financial services companies from achieving organizational agility. The problem lies in the dominance of old technology and bureaucratic culture. The future belongs to financial services firms that build agility into the cogs of business management, from the planning process to the decision-making structure and beyond.

That’s one of the findings from the financial services industry in our global survey of 998 executives, “Measuring Organizational Agility: The Key to Digital Growth.” The majority recognize that driving digital growth is critical to their long-term success. And, perhaps more telling, we found that there is a strong relationship between digital revenue growth and organizational agility.

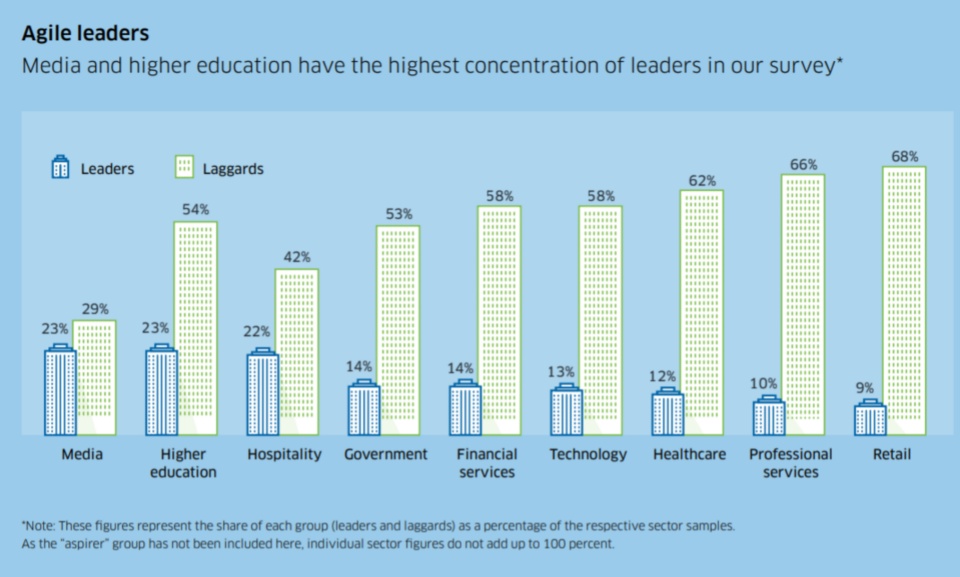

We identified five key behaviors that are critical to organizational agility, and then grouped survey respondents according to their level of adoption of these behaviors. “Leaders” (15% of respondents) achieved high levels of performance in all five behaviors, while ” strivers” (30% of respondents) achieved high levels of performance in four of them, and “laggards” (55%) achieved three or fewer of these behaviors.

Here are the five must-haves for organizational agility:

- Continuous planning. Planning continuously and in real time, which gives organizations the speed, agility and momentum they need to innovate successfully.

- Fluidity of structures and processes. Leading organizations implement fluid organizational structures and processes. Nearly half report being able to quickly reassign people to where their skills are needed.

- Building the workforce of tomorrow. Leaders are far more likely than laggards to have plans to improve the skills of the majority of their workforce and to have specific initiatives in place to increase employee engagement.

- Informed and empowered decision making. In 80% of leading companies, all employees have access to relevant and timely data and are empowered to make appropriate decisions.

- Measurement and guidance. Leaders have made significant progress in developing tools and metrics to measure the performance of digital innovations. This gives them a “fail fast” mentality: 94% say they are able to quickly walk away from unsuccessful projects.

Our survey also provided a breakdown of organizational agility behaviors across industries. In financial services (see infographic below), the percentage of leaders, strivers, and laggards is similar to the breakdown in the overall survey: 14% were identified as “leaders,” 28% as “strivers,” and 58% as “laggards”.

Other key findings on how financial services leaders are driving agility in their organizations include

- More revenue from digital streams. More than half of financial services firms expect more than 50% of their revenue to be digital in three years. Since the study was conducted in late 2019, we believe this number is even higher today as the global pandemic will accelerate the focus on digital revenue.

- The digital strategy is constantly evolving. Seventy-one percent of respondents say their approach to building a growth strategy through digital innovation is constantly evolving.

- A high degree of responsiveness. Sixty-three percent say their organization can quickly reassign people to areas where their skills are needed to take advantage of new opportunities when they arise.

- Career development through skills enhancement. Seventy-five percent of financial services leaders agree that employees are encouraged to grow by learning new skills rather than being promoted.

- Access to digital tools. Seventy percent say their companies have the tools to measure the performance of new digital products and service lines.

Financial services firms mention legacy technologies and bureaucratic culture as the main barriers to organizational agility.

Barriers to achieving organizational agility

These results show that financial services are adopting the behaviors necessary to achieve organizational agility. However, our research also showed that firms recognize that they face some key characteristics that can be problematic.

For example, firms need dynamic planning to be able to respond quickly to changing market conditions and potential threats to the business. But some financial services firms struggle to do this because of the rigidity of existing technologies (which is consistent with what we have found in other studies), bureaucratic organizational culture, and lack of relevant employee skills.

Agile structures and processes are key aspects of organizational agility. Yet, financial services firms again mention legacy technologies and bureaucratic culture as the main obstacles to this goal. Lack of relevant business data and information was also listed as a barrier.

Another barrier to organizational agility is the lack of key performance indicators (KPIs) that reflect the digital age, as reported by 56% of financial services firms in our study.

These results show that financial services are adopting the behaviors necessary to achieve organizational agility. However, our research also showed that firms recognize that they face some key characteristics that can be problematic.

For example, firms need dynamic planning to be able to respond quickly to changing market conditions and potential threats to the business. But some financial services firms struggle to do this because of the rigidity of existing technologies (which is consistent with what we have found in other studies), bureaucratic organizational culture, and lack of relevant employee skills.

Agile structures and processes are key aspects of organizational agility. Yet, financial services firms again mention legacy technologies and bureaucratic culture as the main obstacles to this goal. Lack of relevant business data and information was also cited as a barrier.

Access to data, the motor of digital growth

Data transparency across the organization is the single most important change financial services firms can make to achieve organizational agility. The financial services firms in our research admit that data, while accessible to some extent, is often siloed within functional teams or outdated. This is consistent with the overall average in our survey.

But financial services leaders also recognize that data is key to unlocking digital growth: Two-thirds of financial services firms report that the free flow of information and data, along with standardized processes, are the two most important factors in delegating decision making – and two in five report having full access to data across their organization.

In summary: Financial services must build agility into the fabric of their business. Only then will more financial services companies gain the organizational agility they need to succeed.

Get an overview of “Organizational Agility at Scale: The Key to Driving Digital Growth” or download the full report.